An influx of new meat and dairy alternatives are taking over supermarket shelves for good reason. With dietary preferences and ecological stability in mind, more consumers are reaching for these alternatives than ever before. But they’re not settling for the same vegan options that have been available for decades. They want new, innovative flavors, better textures, and trendy alternatives. In this post, we’ll explore the demand behind this trend, it’s projected longevity, and the innovative products rising up to delight choosy consumers.

The global love of protein

In developed countries, protein is consumed in much higher quantities than even nutrition experts recommend. The average American consumes 103 grams of protein per day, which is almost twice as much as what’s recommended. What’s more, around two-thirds of this amount comes from animal sources, when we examine the average consumer.

Free Whitepaper

Product Lifecycle Management: Learn how to drive innovation, reduce costs and risks and eventually gain a competitive advantage.

And in developing countries like China and India, meat and dairy consumption is on the rise as more and more people are able to afford these products and want to improve their lifestyles. But providing larger amounts of protein is a global challenge that meat and dairy alone can’t keep pace with.

Why non-animal protein is on the rise

Is the push for non-animal protein merely a trend or is it more of a movement? Let’s take a look at the contributing factors to the growth of plant-based protein.

Consumer demand

While most manufacturers are meeting a rising global population with more meat production, others are turning to plant-based protein. There is documented growing demand for plant-based protein.

Plant-based eating is increasing generationally. While 32% of Millennials state that they want to go completely meat free by 2021, 35% of Generation Z say the same thing.

Increased supply

The growth in non-animal protein products doesn’t all come from demand. Supply is also part of the equation. If companies can increase production of non-animal protein products, then that has the potential to increase demand and the impression of the normalcy and desirability of these sorts of products. In turn, this can positively impact the environment, because food suppliers won’t be using all animal products to satisfy a growing population’s demand for protein.

Not only is there a push from consumers to see more tasty options for non-animal protein, but there’s also drive from food manufacturers, government agencies, and non-profit organizations to see higher quantities of and quality of non-animal foods being offered.

Hunger & environmental crisis

Livestock production accounts for around 15% of global greenhouse gas emissions. As the world’s population grows, it would be detrimental to the environment to expand meat and dairy production at the same rate. It’s no wonder then that non-animal protein is being touted as the food technology that has the ability to “save the planet.”

Around the world, investors, innovators, and policymakers are grappling with the question of how the global food supply will be able to feed the growing population. This is why vegan and vegetarian food isn’t just a trend or a fad. It’s a growing movement, with even occasional meat and dairy consumers seeking out plant-based foods in order to balance out their diet for both nutrition and sustainability reasons.

Additionally, plant-based food is seen as a better way to combat global hunger. Around the world, 850 million people are still grappling with starvation. Clearly, continuing to focus on animal-based protein in the way that the food industry has already done for decades will not solve the world hunger problem because it is an expensive, land-consuming endeavor. However, plant-based nutrition has an increased potential to alleviate the global hunger crisis now and in the future.

Challenges in designing products with non-animal derived proteins

Of course, there are tons of challenges associated with creating non-animal derived proteins that consumers will love and that meat and dairy industry lobbyists won’t take down with harmful labeling that make the products seem unnatural.

Variation in reasons for purchasing

One of the biggest challenges with innovating non-animal protein products is simply the fact that the consumers buying them are doing so for different reasons.

- Vegans and vegetarians – Some consumers are motivated to purchase non-animal protein products to replace meat, dairy, and/or eggs because they are either vegan or vegetarian. These consumers are likely to be less picky on flavor or texture because they are often considering animal wellbeing and environmental factors, so giving up the flavors they’re used to is worth it to them.

- “Flexitarians” – People who consume some traditional meat and dairy products in addition to non-animal proteins are often pickier on taste and texture. They might be more motivated by having a balanced diet and less so by concerns for the environment and animal welfare.

- Cost-centric consumers – In certain geographic locations, non-animal protein products can be more affordable sources of protein than animal products. These consumers might be looking for less fancy marketing and trendy ingredients and more simple food replacements that they can use frequently or that they can purchase in bulk when on sale.

Flavor and texture

The motivation behind purchasing non-animal protein products greatly influences how picky consumers will be when it comes to flavor and texture. Consumers who have been accustomed to meat and dairy alternatives for years will be more likely to try new offers, such as pea milk, which is often smoother and creamier than almond milk. But the consumers who are most likely to enjoy pea milk (people who are new to dairy alternatives) will be less likely to try it because they’ll assume it tastes terrible.

Consumer perception

Another big challenge is removing the idea that non-animal protein products are heavily processed. Consumers tend to think of these items as being more processed than their meat and dairy counterparts because they’re taking something and turning it into something else. For example, turning almonds into milk, or beans into burger patties. In reality, meat and dairy products are heavily processed too, but consumers don’t view it this way.

Adherence to labeling policies

Non-animal protein product innovators struggle to adhere to labeling policies put in place by governmental organizations. For example, some US states regulate the usage of words like “meat,” “burger,” “sausage,” and “milk.” Brands can only use these words on their packaging if they also include words like “plant-based,” “made from plants,” or “veggie” to make it clear that these products are not derived from animals.

There will continue to be battles waged over the use of terminology thought to apply to meat, especially as non-animal protein products grow. Governing agencies need to take into account the concerns of meat and dairy farmers while also allowing these terms to be used fairly, because these are the words that consumers themselves use.

Keeping in line with the clean label trend

In addition, food innovators have to cater to consumers desire to “eat clean,” meaning that they want to consume food products that have ingredients lists which they can read, understand, and pronounce. Non-animal protein products often struggle with this, as the protein itself is given overly scientific names such as “hydrolyzed soy protein.”

New innovations that are capturing consumer spend

Now that we understand the drive towards non-animal protein products as well as the challenges these innovators face, let’s take a look at some of the products that are rising to meet the demand while not shying away from these difficult challenges.

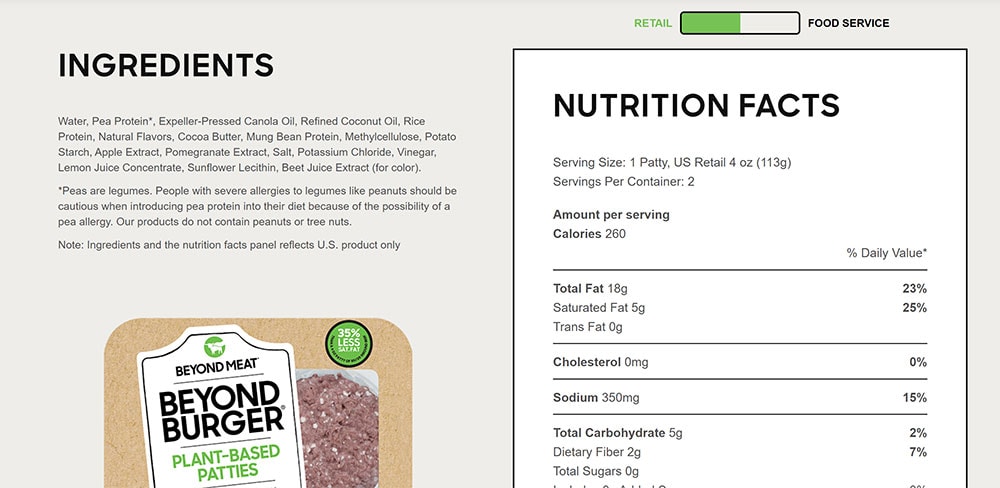

Beyond Meat is one such company that has strived to make their ingredients list as consumer-friendly as possible. While there are still some scientific-looking ingredients, the vast majority of items listed are readily understood, especially when compared with non-animal protein products that have been on the market for much longer than this company’s products.

Non-dairy milks can be used for so many different purposes. SpecPage customer Steuben Foods produces soy, coconut, and almond milk. These products can be purchased as ingredients for other products.

The use cases of non-dairy milk are endless and include:

- Coffee creamers

- Desserts

- Sport protei

- Weight control drinks

- Meal replacement drinks

- Sauces

- Soups

Perfect Day, another customer of SpecPage, partners with food companies, entrepreneurs, and government agencies to bring them great tasting vegan, lactose free milk products including cheese and ice cream.

This company has a very innovative process for developing milk that comes from flora rather than nuts or seeds. Learn more about it from this graphic on their website.

Ultimately, formulating great-tasting non-animal proteins is challenging, but with innovative ingredients manufacturers are up to the task and are creating ingredients that established brands and entrepreneurs will be able to offer for generations.

SpecPage is a SaaS PLM that helps product innovators work from anywhere and save dozens of hours a month.