Clean eating has gained in popularity in the past decade. Paleo, Keto, and other simple, whole-foods-based diet trends keep consumers searching for very particular sauces, seasonings, and pre-made meals when they’re not able to cook.

But when the desire for clean, natural food is met with a plant-based diet, things get complicated.

Interestingly, plant-based foods are rising in popularity in part because of the clean eating trend, but these foods are also met with unique challenges. Meat substitutes struggle to match consumer expectations for clean eating and regulatory demands on labelling.

What is clean label?

Maria Velissariou, Chief Science and Technology Officer for IFT says, “Clean label is not a scientific term. Rather, it is a consumer term that has been broadly accepted by the food industry, consumers, academics, and even regulatory agencies. Essentially, clean label means making a product using as few ingredients as possible, and making sure those ingredients are items that consumers recognize and think of as wholesome—ingredients that consumers might use at home.”

Free E-Book

How Can Food Producers Strategize for Industry 4.0? Learn how to build a foundation that supports change and spurs growth!

Essentially, clean label is not a specific food certification in the way that organic or gluten free are. Rather, clean label means using food ingredients that are recognizable and short.

To be clear, clean label isn’t a phrase that consumers are knowledgeable about or discuss, but it is a trend that they seek out in their purchases.

A great example of a clean label is the American protein bars brand called RXBAR. In recent years, they rose to extreme popularity very quickly by offering a quality product with a striking, easy-to-read list of ingredients. Aside from the general attractiveness of the packaging, this labelling makes the product feel healthier (despite being relatively sweet) to today’s consumers.

Why clean label is a challenge for plant-based food brands

The clean eating trend is growing. In the US, the clean label ingredients market alone was valued at $38.8 billion in 2018, and is forecasted to reach $64.1 billion by 2026. These ingredients include natural color such as hibiscus, natural flavor, starches and sweeteners, and natural preservatives.

Consumers want to know and understand what they’re eating. They want to avoid ingredients in food products that they wouldn’t be able to cook with themselves. When they’re too busy to cook, they don’t want to sacrifice their values to eat.

At the same, the demand for vegan and plant-based foods has skyrocketed in recent years. The US market for plant-based foods reached $5 billion in 2019, higher than any year on record. In 2018, plant-based foods in the US totalled $4.5 billion. The global plant-based food market is also forecasted to grow.

The challenge comes when you combine the desire for plant-based foods with clean labels.

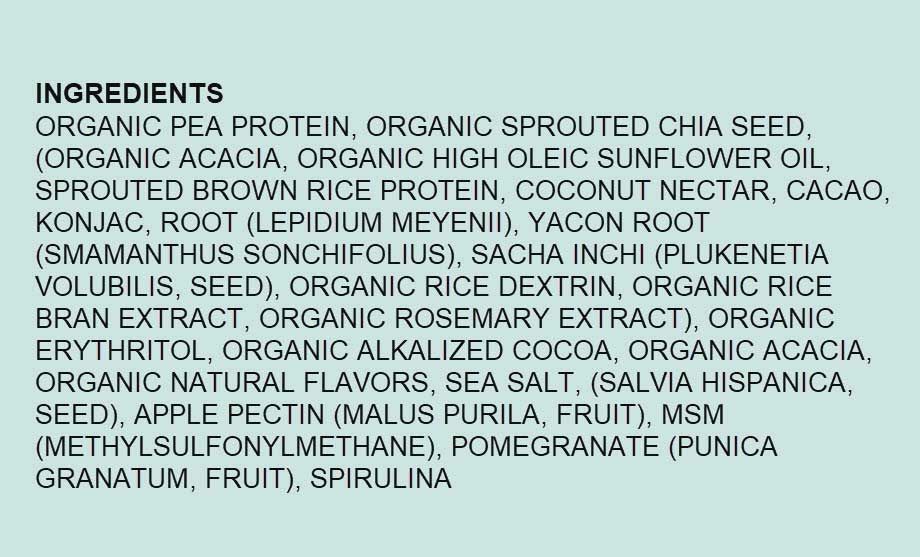

Just take a look at this example of a vegan plant-based product:

While this ingredient list is entirely healthy, it is also extremely long and includes several ingredients that consumers will struggle to read and pronounce. This can lead to lower product sales, especially as new plant-based food products emerge and strive to innovate their recipes in a way that consumers can connect with.

Ingredients that clean eaters take issue with

Because plant-based foods often rely on alternatives to animal protein, they are prone to the following issues which clean-eating consumers despise:

- Unrecognizable ingredients

- GMOs

- Heavily processed ingredients

- New, unknown ingredients

Although meat and dairy products are also heavily processed and involve many procedures that consumers aren’t aware of, so-called “fake” meat and dairy products are considered to be more unnatural and processed.

The ingredients that consumers will be turned off by are the very ingredients that are often essential to creating the meat or dairy replacements, such as proteins and thickening agents. They can seem unnatural and unappealing to consumers who want to eat both plant-based food and clean food.

New regulation on familiar terms: US

To make matters even more challenges for plant-based food companies, some countries are passing regulations on what terminology can be used.

Some US states have been restricting the usage of popular terms like “meat,” “sausage,” and “burger” if the product is not derived from animal meat. Other states have clarified their laws in that using meat terminology is allowed if the ingredients are made clear on the front of the package without having to do a detailed scan of the nutrition panel.

The Mississippi Department of Agriculture recently proposed new regulations that allow plant-based companies to use the words “meat,” “sausage,” “burger,” or similar, if they also include on their package something like “made from plants,” “veggie-based,” “vegan,” “vegetarian,” or similar.

New regulation on familiar terms: Europe

Similar regulations have surfaced in Europe, where recently, the EU Parliament was faced with a decision on whether or not to ban the use of animal-related names to the labels of vegan/vegetarian products. In other words, if banned, the name “vegan nuggets” or “almond milk” could not be allowed; companies would have to rebrand their products to something like “vegan chunks” or “almond drink.”

Fortunately for some of these companies, the EU rejected the ban on meat substitutes, but approved the ban for vegan dairy products. That means that while “Veggie Burger” is here to stay, companies may be restricted with their use of “cheese,” “yogurt,” etc.

These laws on the American and European fronts are designed to make things clear for consumers and fair for brands. As long as the companies clearly state the product is not made from animal products, they’re mostly free to use those common words that people use to describe food. Imagine trying to sell a veggie burger without being able to call it a burger! That doesn’t serve anyone, least of all the consumer.

What plant-based food companies are doing to meet consumer needs

Competition is rising. Plant-based food companies recognize that the demand is growing, and they’re not giving up on discovering great-tasting meat alternatives with recognizable ingredients. In fact, the demand for plant-based foods is growing so much that even meat brands are buying stock in these new companies.

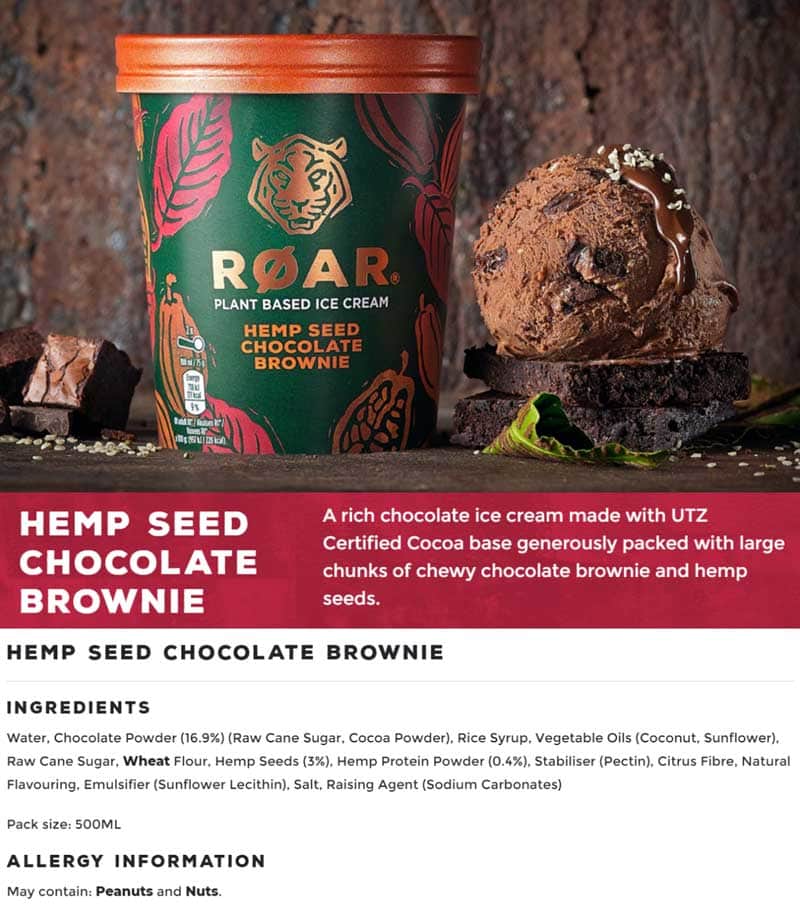

SpecPage customer, Froneri, is one company that has chosen to match this demand with their innovative plant-based ice cream.

A quick scan of the ingredients list shows that this brand is working hard to make the ingredients as recognizable and simple to consumers as possible.

As both of these trends continue to grow, the challenges and opportunities will too. Brands will push their recipe innovation further, to provide excellent taste and simple ingredients to consumers seeking meat alternatives.

Learn more about SaaS PLM SpecPage.